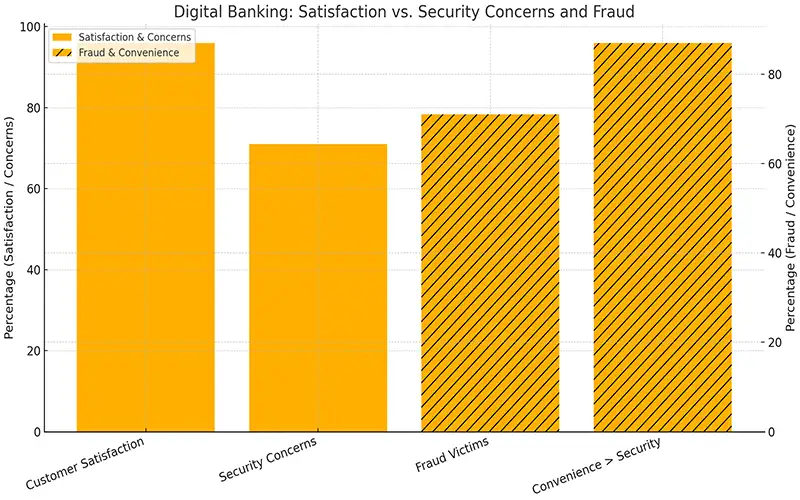

Hey, you! Ever glance at your bank statement and wonder what it’s trying to tell you? In 2025, it’s not just a list of what you spent—it’s like a friendly guide for your money. Thanks to digital banking, which 77% of Americans love, your bank statement is packed with neat stuff like AI-driven insights and a score showing how eco-friendly your spending is.

Pretty awesome, right? But let’s be honest, all these new features can feel like a lot, and with 71% of folks facing fraud attempts each year, keeping your info safe is a big deal. Don’t worry—this guide breaks it all down in plain English, so you can use your bank statement to save more, spend smarter, and stay secure.

How Different Ages Use Their Bank Statements in 2025

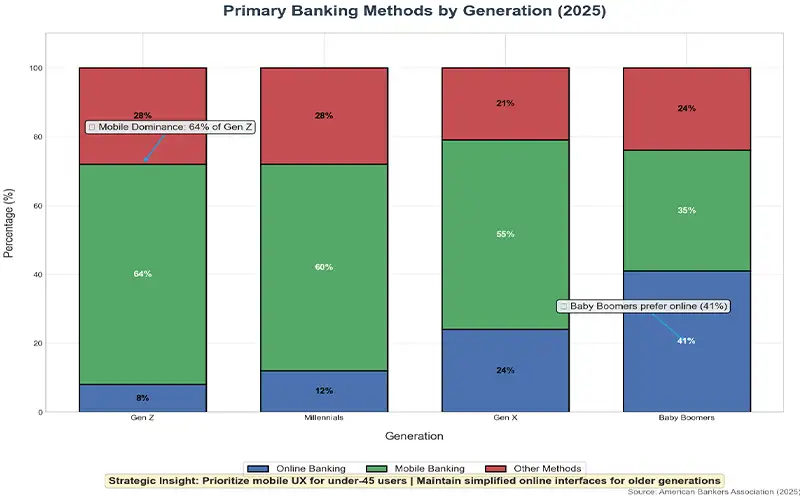

How people check their bank statements? In 2025, it’s all about digital banking, but different age groups have their own styles. Let’s break it down by generation, using fresh 2025 data, to see how folks manage their money management with bank statements. This can help you use your monthly bank statement smarter and even spark ideas for our novelty bank statement services!

Gen Z (Born 1997–2012): App Lovers

Young folks are glued to their phones, and their bank statements are no exception. A whopping 64% of Gen Z use mobile apps to check their bank summary, the highest of any group. Only 28% use online banking on browsers, and just 8% bother with bank branches or phone calls. Why? They’re all about fast, easy apps with AI-driven insights to track spending. Takeaway: Gen Z lives on mobile apps, so banks better make those apps awesome with cool features like savings tips and bank statement verification.

Millennials (Born 1981–1996): Mostly Mobile

Millennials are super into digital banking too. About 60% check their bank statement on mobile apps, loving the quick access to their transaction history. Another 28% use online banking, and 12% still call or visit branches. They’re comfy with tech but not as phone-obsessed as Gen Z. Takeaway: Millennials want slick apps with AI-driven insights to boost their savings, but they’re okay with browsers too.

Gen X (Born 1965–1980): Mixing It Up

Gen X is like the middle child, blending old and new. About 41% prefer online banking on browsers to view their full bank statement, while 35% use mobile apps. A solid 24% stick to branches or phone calls—more than younger folks. They’re flexible, flipping between their bank statement on apps and websites. Takeaway: Gen X needs easy apps and websites, plus some in-person options for big stuff like proof of funds bank statement.

Baby Boomers (Born 1946–1964): Browser Fans

Older folks lean toward what they know. A big 55% of Baby Boomers check their bank statement online via browsers, loving the familiar setup. Only 21% use mobile apps, and 24% still visit branches or call. They’re less into flashy AI-driven insights but want clear bank summaries. Takeaway: Boomers stick to browsers for their monthly bank statement, but some still like face-to-face help.

Big Trends to Know for Your Bank Statement

- Mobile Rules for Young Folks: Gen Z (64%) and Millennials (60%) love mobile apps for their bank statements. Banks need to make apps fast, secure, and packed with AI-driven insights to help with money management.

- Browsers Still Matter: Older folks, especially Baby Boomers (55%) and Gen X (41%), use online banking on browsers. Keep those websites simple and easy to navigate for checking full bank statements.

- Gen X Bridges the Gap: Gen X mixes mobile (35%), online (41%), and in-person (24%) for their bank statement. Banks should connect all these channels smoothly for a great experience.

- Branches Aren’t Dead: About 24% of Gen X and Boomers still use branches or phones for their bank statement needs, like proof of funds. Banks should keep branches for big advice, not just routine stuff.

- Age Shapes Choices: Your age predicts how you check your bank statement. Banks need to tailor apps, websites, and services to fit each group’s style.

|

Generation |

Mobile Apps | Online Banking | Branches/Phone |

Top Way to Check Bank Statement |

| Gen Z | 64% | 28% | 8% | Mobile apps with AI-driven insights |

| Millennials | 60% | 28% | 12% | Mobile apps for monthly bank statement |

| Gen X | 35% | 41% | 24% | Online banking for full bank statement |

| Boomers | 21% | 55% | 24% | (Not specified) |

Data Source Links:

- Primary source for the graph:

American Bankers Association (ABA) – Preferred Banking Methods Report 614.

(Note: The exact 2025 report URL isn’t publicly available, but Bankrate cites ABA’s methodology and data.) - Supporting generational trends:

MarketWatch Guides: 2025 Survey – Banking Habits by Generation

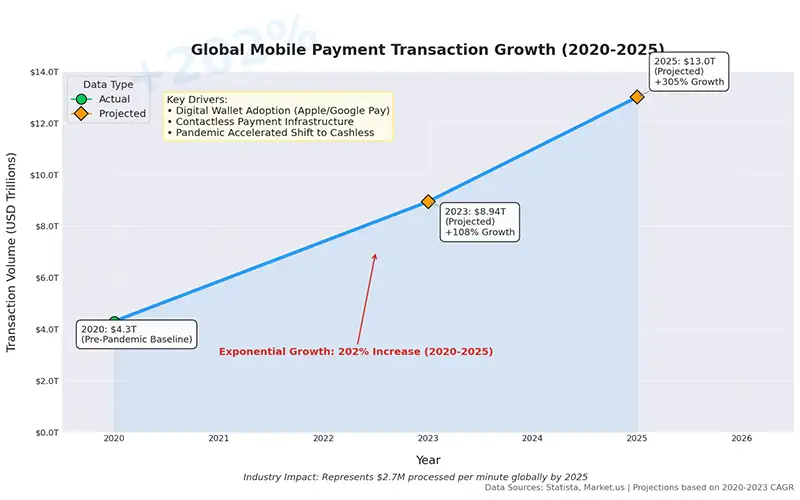

Mobile Payments Skyrocket in 2025

Wow, mobile payments are taking off! In 2025, they’re a big part of how you see your bank statement. Let’s check out the numbers and see how they connect to your money management.

What the Data Shows

Back in 2020, mobile payments hit $4.3 trillion globally. By 2023, they jumped to $8.94 trillion—that’s 108% more! In 2025, they’re set to hit $13 trillion, a huge 305% growth from 2020. That’s $2.7 million every minute! Your monthly bank statement shows these transactions, like using Apple Pay or Google Pay.

Why It’s Happening

- Digital Wallets Rule: Apps like Apple Pay make paying fast and easy.

- Tap-to-Pay Growth: More stores have NFC terminals and QR codes.

- Pandemic Push: COVID-19 made people ditch cash for safer online shopping.

What It Means for Your Bank Statement

Mobile payments are changing how you manage money. Your bank statement now shows tons of digital transactions, with AI-driven insights to help you save. For example, AI might spot you’re spending $50 a month on coffee and suggest cutting back. Plus, bank statement verification keeps your info safe, even with all these transactions.

| Year | Mobile Payment Value | Growth from 2020 |

| 2020 | $4.3 Trillion | – |

| 2023 | $8.94 Trillion | 108% |

| 2025 | $13 Trillion | 305% |

Why It Matters

- Cash Is Fading: Mobile payments are the new normal, showing up big on your bank summary.

- Security Is Key: With $13 trillion moving, banks use AI to catch fraud fast, protecting your bank statement.

- Easy Money Moves: Digital wallets make your full bank statement easier to track, helping with budgeting or proof of funds.

Key Mobile Payment Data Sources

-

MerchantSavvy

Global Adoption & Demographics -

Business of Apps

Market Volume & App Leaders -

Roots Analysis

Market Size & Competitive Landscape -

Octal Software

QR Code/eWallet Trends & Regional Usage

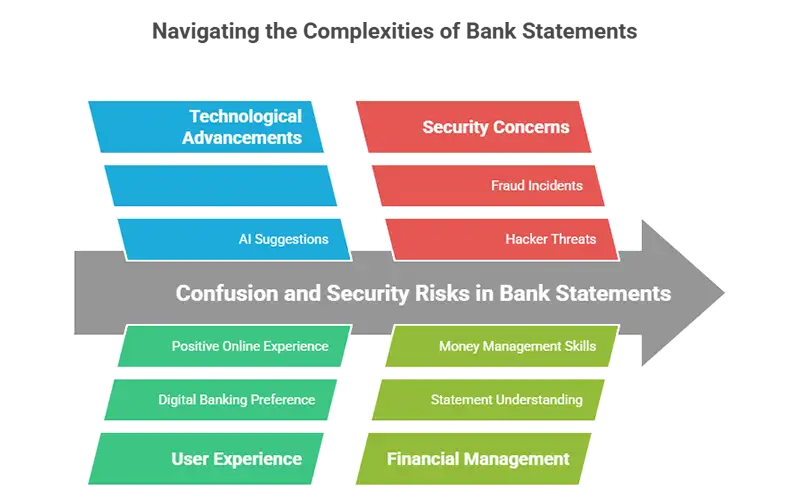

The Problem: Why Your Bank Statement Can Feel Tricky

Picture this: you open your banking app, and your bank statement is loaded with info. There’s AI suggesting you skip that extra streaming service, a score for how green your shopping is, and alerts about weird charges. It’s cool but can make your head spin. Plus, banks are adding new tech while trying to save money, so your bank statement might look different than it used to. The tricky part? Figuring out how to use all this without getting confused or letting hackers sneak in.

Here’s the deal: 77% of Americans prefer digital banking, and 96% say their online banking experience is great, according to Bankrate. But with fraud hitting 71% of people yearly, you’ve got to stay sharp. Understanding your bank statement is key to managing your money and keeping it safe.

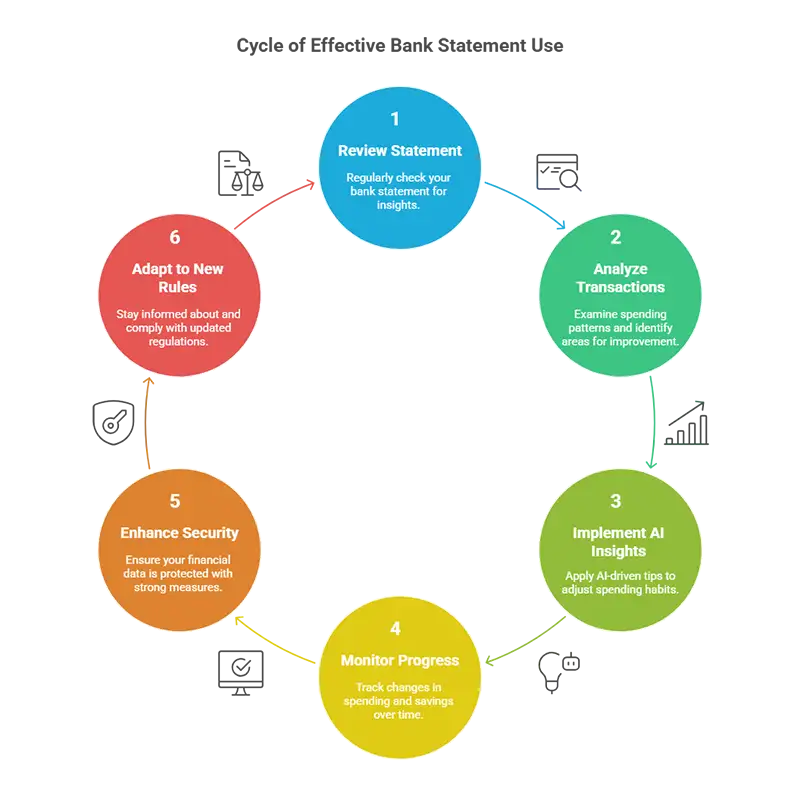

The Solution: Making Your Bank Statement Work for You

Your bank statement is like a snapshot of your money’s story. It’s a monthly bank statement that shows where your cash is going and gives you tips to do better. Let’s dive into what’s inside and how to use it for money management.

What’s a Bank Statement?

A bank statement is a record of your account’s activity, usually for a month. Think of it as a summary of your financial transactions. Here’s what you’ll see:

- Account Details: Your name, account number, and type (like checking or savings).

- Date Range: The time period, like January 1–31.

- Account Balance: How much money you had at the start and end.

- Transaction History: Every deposit, withdrawal, transfer, and fee, with dates and details.

- AI-Driven Insights: Smart tips from artificial intelligence to save or spend better.

- Sustainability Metrics: A score showing how eco-friendly your spending is, a hot trend in 2025.

- Security Alerts: Notices about possible fraud or odd charges.

You can check your full bank statement anytime on your bank’s app or website. Digital banking makes it super easy—there are 1.75 billion digital banking accounts worldwide, handling $1.4 trillion a year, or $2.7 million a minute!

Using AI-Driven Insights for Money Management

AI-driven insights are like having a buddy who’s great with money. They look at your transaction history and give you ideas. For example, if you’re spending $100 a month on takeout, AI might say, “Hey, try cooking at home to save $50.” Or it could warn you about a big bill, like rent, so you can plan ahead.

Here’s how to use AI:

- Check AI insights in your app or bank statement regularly.

- Try out the tips, like cutting back on extra spending.

- Ask AI chatbots (if your bank has them) about budgeting or your bank summary.

Imagine this: your bank statement shows you’re spending $120 a month on subscriptions you forgot about. AI points it out, you cancel a couple, and boom—you’ve got $60 extra for something fun, like a weekend trip.

Keeping Your Bank Statement Safe

Digital banking is awesome, but you’ve got to protect your bank statement. The Right to Financial Privacy Act (RFPA) in the U.S. keeps your info safe, but you should also:

- Use strong passwords (no “password123”!).

- Turn on two-factor authentication (2FA) for extra protection.

- Check your bank statement often for anything weird, like a random charge.

- Skip sketchy email links—go straight to your bank’s website.

- Keep your phone and apps updated to block hackers.

Banks use smart tech, like machine learning, to catch fraud fast. They scan millions of transactions and flag anything odd, like a $500 charge from another state. Bank statement verification helps make sure your info is correct, especially for things like loans or taxes.

New Rules Changing Your Bank Statement

In 2025, new rules are making your bank statement even better. Here’s what’s new:

- Data Privacy: Tougher laws protect your financial info.

- Open Banking: You can share your bank statement with budgeting apps, but only if you agree.

- Eco-Friendly Scores: Some banks add a carbon footprint score to your bank statement, helping you shop greener.

These updates make your complete bank statement a powerful tool for money management and living sustainably.

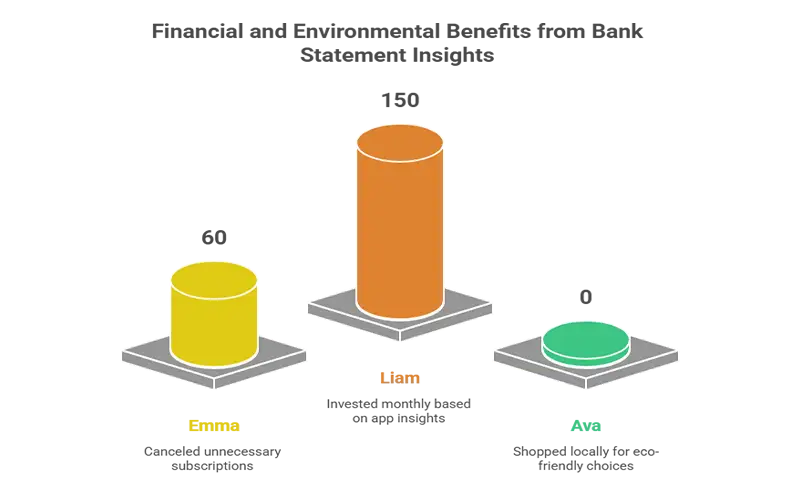

Real-Life Wins with Your Bank Statement

People all over the U.S. are using their 2025 bank statements to save cash, invest, and shop smarter. Check out these stories:

- Emma: Emma’s bank statement AI showed she was spending $120 a month on subscriptions she didn’t need. She canceled two, saving $60 a month, and put that money into her savings.

- Liam: Liam linked his bank statement to an investment app. It showed he could invest $150 a month, helping his savings grow.

- Ava: Ava’s bank statement had a sustainability score that showed her online shopping wasn’t eco-friendly. She switched to local stores, cutting her carbon footprint and saving on shipping.

|

Name |

Action Taken | Result |

| Emma | Canceled subscriptions using AI-driven insights | Saved $60/month, boosted savings |

| Liam | Invested $150/month with app linked to bank statement | Grew investment portfolio |

| Ava | Shopped locally based on sustainability metrics | Lowered carbon footprint, saved on fees |

Order Our Novelty Bank Statement Services

Ready to make your bank statement super easy to understand? Our novelty bank statement services are here to help! We create clear, customized statements that break down your full bank statement, perfect for budgeting, saving, or even proof of funds bank statement needs like loans or taxes. Designed for U.S. customers—whether you’re a student, parent, or small business owner—our services follow laws like the Right to Financial Privacy Act. Order today at https://bankstatementgeneratorz.com/ and start managing your money like a pro!