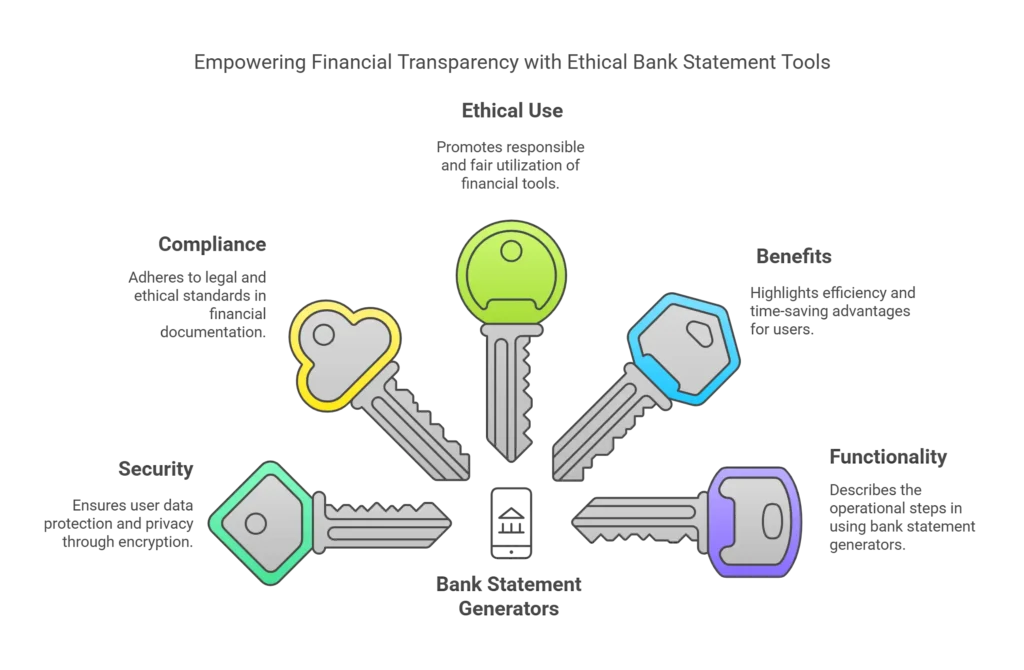

In an era where financial transparency is non-negotiable, the ability to organize and present your monetary history efficiently can make all the difference. Enter the bank statement generator—a tool that’s reshaping how individuals and businesses manage their fiscal narratives. Whether you’re planning a loan application, reconciling expenses, or crafting a financial forecast, understanding how to leverage these tools responsibly is key. Let’s unpack the essentials.

What Is a Bank Statement Generator?

A bank statement generator is a digital solution designed to create accurate, professional-looking bank statements. These tools replicate the format of official documents issued by financial institutions, complete with transaction histories, balances, and account details. While they’re often used for personal financial planning or business mock-ups, their utility spans educational demonstrations and budgeting exercises.

However, it’s critical to distinguish these tools from official bank-issued statements. Reputable platforms like BankStatementGeneratorZ emphasize ethical use, ensuring generated documents are flagged as prototypes or educational aids—never substitutes for legitimate financial records.

Why Use a Bank Statement Generator?

-

Streamlined Financial Planning

Imagine projecting your savings growth over six months or simulating cash flow for a startup. A bank statement generator allows you to model scenarios visually, helping you make informed decisions without waiting for official statements.

-

Time Efficiency

Manually recreating a bank statement’s layout is tedious. Tools like SwifDoo PDF automate formatting, letting you focus on data accuracy rather than design.

-

Educational and Professional Use

From training finance teams to illustrating budgeting workshops, these generators serve as practical teaching aids. They’re also invaluable for creating client-facing mock-ups in banking or real estate.

Legal and Ethical Considerations

While bank statement generators offer flexibility, misuse can lead to severe consequences. For instance, submitting fabricated statements for loan applications or rental agreements is illegal. Always:

- Disclose the document’s purpose if sharing it externally.

- Verify requirements with institutions—official requests typically mandate authenticated statements from your bank.

- Prioritize security by using platforms with encryption, like SlikSafe, to protect sensitive data.

How to Generate a Bank Statement: A Step-by-Step Approach

-

Choose a Reliable Tool

Opt for generators with strong reviews and clear disclaimers about ethical use. BankStatementGeneratorZ’s service page offers templates tailored to U.S. banking standards, ensuring compliance and realism.

-

Input Accurate Data

Enter account details, transaction dates, and balances. Some tools, like DOCSUMO, even extract data from spreadsheets to minimize manual entry.

-

Customize the Layout

Adjust fonts, logos, and headers to mirror your bank’s format. SwifDoo PDF’s AI-driven editor simplifies this process.

-

Review and Export

Double-check figures and formatting. Download the statement as a PDF or Excel file for easy sharing.

Top Bank Statement Generators Compared

| Tool | Key Features | Best For |

| SwifDoo PDF | AI-driven editing, template customization | Businesses, educators |

| TemplateLAB | Free pre-designed templates | Quick personal projects |

| BankStatementGeneratorZ | U.S.-compliant formats, security focus | Loan applicants, planners |

| SignNow | Cloud-based editing, no downloads required | Collaborative teams |

| Verif Tools | Bank-specific templates | Detailed financial models |

When Not to Use a Bank Statement Generator

When Not to Use a Bank Statement Generator

While these tools are versatile, they’re no match for official documents in legally binding scenarios. For example, mortgage lenders or visa applications often require verified statements directly from your bank.

Final Thoughts: Empowerment Through Responsibility

The rise of bank statement generators reflects a broader shift toward DIY financial management. Yet, their power hinges on ethical application. By using these tools to clarify—not obscure—your financial story, you unlock smarter planning and clearer communication.

Ready to explore? Create a custom statement tailored to your needs, and remember: transparency isn’t just a best practice—it’s the backbone of trust.